Reading Time: Approximately 6-8 minutes.

escrow accounts; wrap mortgages; real estate financing; borrower-lender trust; financial stability; mortgage management

In the complex world of real estate financing, wrap mortgages present a unique opportunity for lenders to work directly with borrowers while maintaining the original mortgage on a property. However, this unique arrangement comes with its own set of challenges, one of which is effectively managing escrow accounts. For wrap mortgage lenders, mastering escrow account management is crucial to ensuring the smooth operation and financial security of the loan.

Why Escrow Accounts Matter in Wrap Mortgages

Escrow accounts act as a financial safeguard in mortgage agreements, serving to collect and distribute funds for property taxes and insurance premiums. In a wrap mortgage, where the lender often assumes greater risk by holding the existing mortgage while creating a new one, managing these accounts becomes even more critical.

1. Timely Payments for Peace of Mind

One of the primary reasons escrow accounts are vital is that they ensure property taxes and insurance premiums are paid on time. This not only protects the property from tax liens and uninsured losses but also safeguards the borrower’s credit rating and the lender’s investment. Late payments can result in penalties, interest charges, and potentially, legal issues.

2. Protection for Both Parties

A well-managed escrow account protects both the borrower and the lender. For borrowers, it ensures that funds are available when tax and insurance payments are due without the stress of financial planning. For lenders, it minimizes the risk of default and protects their collateral—the property.

3. Building Trust and Transparency

Escrow accounts facilitate transparency and trust between the borrower and lender. By having a clear record of payments and disbursements, both parties can ensure that financial obligations are being met. This transparency is crucial in maintaining a positive relationship and ensuring the long-term success of the wrap mortgage agreement.

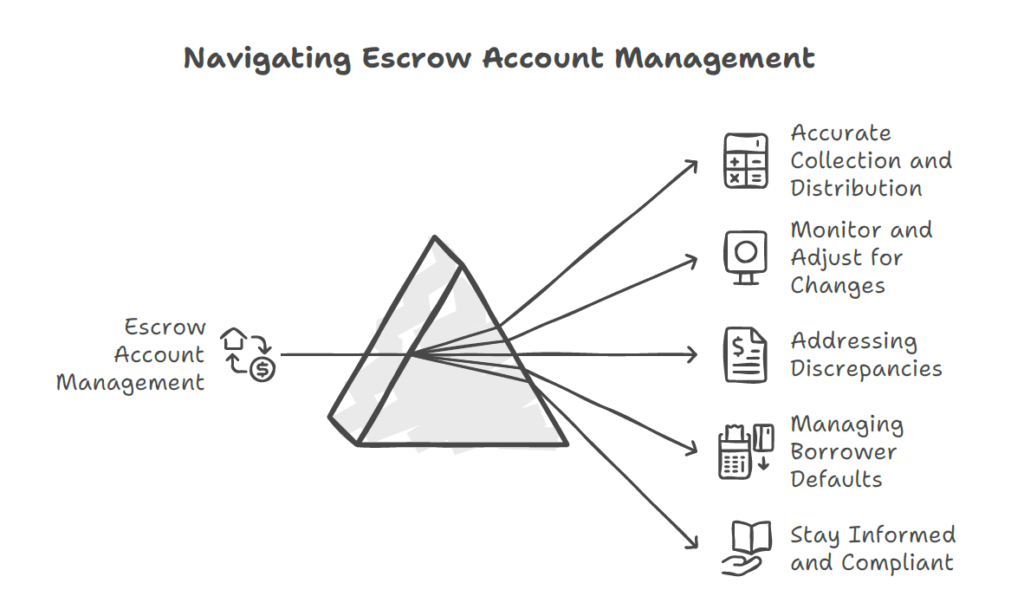

Best Practices for Managing Escrow Accounts

Effective management of escrow accounts in wrap mortgages involves several best practices to mitigate risks and ensure compliance.

1. Accurate Collection and Distribution

Ensure that the correct amount is being collected and distributed from the escrow account. This means regularly reviewing property tax assessments and insurance premiums to adjust contributions as needed. It’s essential to avoid the pitfalls of underfunding or overfunding the account, which can lead to financial strain or unnecessary accumulation of funds.

2. Monitor and Adjust for Changes

Be vigilant about potential delays in property tax assessments or changes in insurance premium rates. Such changes can impact the amount required in the escrow account. Proactively monitoring and adjusting contributions can prevent shortfalls or excesses.

3. Addressing Discrepancies

Regularly conduct escrow analyses to identify and address any discrepancies or errors. This ensures that the account reflects accurate financial obligations and prevents surprises for both borrower and lender.

4. Managing Borrower Defaults

Implement strategies for handling borrower defaults or missed payments. These can significantly affect the escrow account balance and compliance with loan terms. Clear communication and predefined procedures can help manage these situations effectively.

5. Stay Informed and Compliant

Finally, staying informed about changes in tax laws, insurance requirements, and escrow regulations is essential. Compliance with legal and regulatory requirements not only protects the lender but also reinforces accountability and trust with borrowers.

Challenges in Escrow Management

Managing escrow accounts in wrap mortgages is not without challenges. Common issues include ensuring the correct amounts are collected and distributed, dealing with potential delays in property tax assessments, addressing discrepancies in escrow analyses, and handling borrower defaults. Lenders must also stay informed about regulatory changes that could impact escrow management.

Conclusion

For wrap mortgage lenders, managing escrow accounts is a vital component of ensuring financial stability and fostering trust with borrowers. By implementing best practices and remaining vigilant about changes and challenges, lenders can effectively manage escrow accounts, protect their investments, and strengthen their relationships with borrowers.

Interested in learning more about how we can help you manage your escrow accounts effectively? Contact us today to see how our expertise can support your business goals.

You're Leaving Our Site

You’re about to be redirected to our secure loan portal. Please note:

Your Company ID will always be OPL when logging in